Introduction

The world of quantum computing has attracted the attention of investors and those , those interested in the technology, and dwave share price has become a major player in the revolutionary space.

Understanding Dwave’s share price trends , trends has become crucial for those looking to capitalize on the growing potential of quantum technologies. Unlike traditional computing companies, D-Wave’s value is driven by a combination of technological breakthroughs, market demand for quantum solutions and strategic partnerships with industry giants.

This article provides the latest insights on Dwave’s share price, examining factors influencing market , market performance, investor sentiment and future growth prospects. Like, For anyone following quantum , quantum computing investments, understanding these dynamics can be a significant advantage in making informed decisions.

Table of Contents

And oh yeah, Learn about dwave share price and its market position

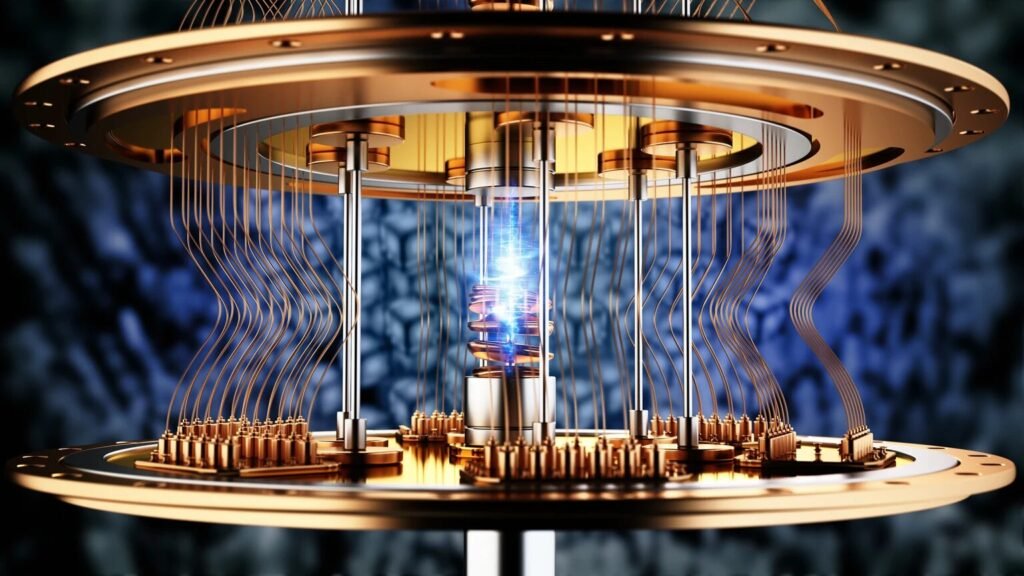

Founded in 1999, dwave share price Systems is known , known for its pioneering quantum annealing technology. Unlike conventional digital computers, that process bits in a binary state, D-Wave’s quantum computers use qubits to perform very complex calculations faster.

Seriously, This capability uniquely positions the company in the growing quantum computing industry. Like, Investors are often interested in how this technology can transform sectors such as cryptography, logistics, artificial intelligence and pharmaceutical research.

Key points , points of dwave share price technology

Quantum Heating: SPECIALIZED in solving , solving optimization problems for classical computers.

Like, Partnerships: Partnerships with companies such as NASA, Google and Lockheed Martin add credibility.

Software ecosystem: The Leap platform enables cloud-based access to D-Wave quantum computers, making it easier for businesses to deploy them.

These , These technological developments, coupled with increased corporate interest in quantum solutions, contribute to Dwave’s share price volatility, reflecting investor excitement and caution.

Factors Influencing Dwave Share Price

There are a bunch of factors that affect the D-Wave rating so a detailed analysis of them is crucial.

Technological breakthroughs

dwave share price stock price often reacts to announcements of new hardware or software developments. For example when the company introduced the Advantage system that contains more than 5000 qubits there , there was a surge in market , market interest for potential applications in solving , solving complex problems.

Market acceptance

The rate at that companies adopt quantum computing solutions directly affects investor sentiment. A high , high adoption rate indicates growth , growth potential that , that positively affects Dwave’s share price.

And oh yeah Strategic partnerships

Cooperation with renowned technology companies and research institutes is a vote of confidence. Partnerships with , with organizations like Google prove that D-Wave technology is recognized by industry leaders that stabilizes its market value.

You know what? Economic conditions

Broader market trends and economic indicators also play a role. During periods of economic uncertainty investors may be cautious about high-tech investments that may result in volatility in Dwave’s stock price.

Regulatory environment

Government policies related to the funding of quantum research and the introduction of the technology can indirectly affect a company’s valuation. Countries that invest in quantum technology can create a favorable environment for D-Wave to grow , grow increasing investor confidence.

Challenges and risks dwave share price

, risks Investing in dwave share price also , also comes with certain risks that you should consider.

You know what? Uncertainty in the market

Quantum computing is an emerging industry and its widespread adoption may take longer than expected impacting stock performance.

You know what? Competitive landscape

Other companies including IBM and Rigetti are also developing quantum computing. Competition may affect , affect D-Wave’s market , market share and investor sentiment.

You know what? Technological limitations

While quantum computing holds enormous potential practical limitations and high costs can slow its adoption impacting financial performance.

Regulatory and security risks

Government regulations intellectual property challenges and cybersecurity concerns may pose additional risks to D-Wave’s operations and market valuation.

Future Outlook for dwave share price

Despite the challenges the future , future of D-Wave looks promising due to the following factors:

The quantum cloud service is expanding

Leap’s cloud platform enables broader enterprise access to D-Wave’s quantum computers expanding potential revenue streams.

Industry acceptance is growing

As industries such as logistics pharmaceuticals and finance increasingly rely on quantum computing to solve complex problems D-Wave stands to benefit.

And oh yeah Seriously constant innovation

Continuous research and development in qubit and qubit technology and software development enhances D-Wave’s competitiveness and supports long-term growth.

Willingness to invest

Investor interest in quantum computing is growing reflecting optimism about D-Wave’s potential and positive impact , impact on its share , share price.

guess? Actionable insights and recommendations for dwave share price investors

Investing in dwave share price isn’t just about tracking the stock; its about understanding the rapidly evolving technological frontiers. Quantum computing is still in its infancy and the market , market is sensitive to both technological breakthroughs and speculative trends. Here’s a detailed roadmap for making informed investment decisions:

1. Seriously Take a long-term perspective

Quantum computing is a fast-growing but high-risk industry… Unlike traditional technology companies D-Wave’s financial performance does not necessarily immediately reflect its technological progress. For investors:

Focus on future possibilities: Consider how D-Wave’s quantum annealing technology can revolutionize industries such as pharmaceuticals, logistics and artificial intelligence.

Ignore short-term swings: Stock price swings are often driven by hype around announcements or global market changes, rather than fundamental performance.

Be patient: Adoption of quantum computing is gradual. And oh yeah, Strategic patience can pay big rewards as technology advances and business becomes more widespread.

2. Follow-up of partnerships and strategic cooperation

D-Wave’s value is strongly tied to its partnerships with existing organizations. The most important aspects are:

Tech Collaborations: Look out for partnerships with , with tech giants , giants like Google , Google or NASA that demonstrate confidence in D-Wave technology.

Corporate deals: New deals with pharmaceutical, logistics or financial companies can directly affect share prices by signaling potential for revenue growth.

Government initiatives: Grants or national quantitative research programs can increase D-Wave’s credibility and increase investor confidence.

By tracking these developments, investors can anticipate positive stock , stock price movements before they become widely known.

3. You know what? Diversification to manage dwave share price

Investing only in emerging technology companies such as dwave share price can be risky due to market , market volatility. A diversified portfolio reduces the following risks:

Combination with traditional technology stocks: balances stability with growth potential.

Guess what? Pick up other quantum computing stocks: Companies like IBM, Rigetti, or IonQ provideexposure to the quantum , quantum sector while diversifying risk.

Consider ETFs or Mutual Funds: Some technology-focused ETFs also include companies in the quantum computing space, reducing reliance on individual stocks.

Diversification doesn’t eliminate risk, but it does prevent the performance of a single stock from disproportionately affecting your entire portfolio.

4. Keep up to date with technological developments

D-Wave’s stock price reacts , reacts to breakthroughs in qubit technology, software developments and quantum matching capabilities. For investors:

Follow , Follow product announcements: New systems with higher qubit counts or better stability can create optimism in the market.

And oh yeah, Analysis of Software Developments: Updates to D-Wave’s Leap platform can expand enterprise reach , reach and increase revenue.

Competitive Benchmark Evaluation: Compare D-Wave’s performance to other quantum computing companies to understand the market landscape.

Staying informed about technological developments ensures that you’re not just reacting to stock market speculation.

Seriously, 5. Understanding market risks

No investment is without risk, and dwave share price brings unique challenges that , that must be considered in any strategy:

Early-stage application: Practical applications of quantum , quantum computing are still emerging, making immediate returns , returns uncertain.

Strong competition: Competitors such as IBM and Google are developing rapidly, that , that may affect D-Wave’s market share.

Economic Volatility: A global economic downturn or a slowdown in the technology sector could reduce investor appetite for high-risk emerging technology stocks.

Regulatory Barriers: Intellectual property disputes or changes in government policy can affect operations and valuation.

Recognizing these risks helps investors maintain realistic expectations and avoid rash decisions.

6. Leverage analyst , analyst reports and market dwave share price

Investors can gain a competitive advantage by regularly reviewing:

Financial Reports: D-Wave’s quarterly or annual disclosures provide insight into , into revenue, R&D spending, and strategic direction.

Like, Market , Market Sentiment Analysis: Monitor investor forums, news and ANALYST reports to gauge broader sentiment on D-Wave’s opportunities.

Historical Performance Charts: Study past stock price trends to identify patterns or reactions to major announcements.

Combining quantitative and qualitative data can lead to smarter investment decisions.

7. And oh yeah, Consider timing and entry points

Quantum computing is a branch where timing is important. While long-term growth is possible, choosing strategic entry points can increase returns:

Post-announcement declines: Stocks sometimes fall , fall immediately after an announcement due to profit-taking; These , These may represent a buying opportunity.

Key contract wins: Entry after signing , signing new corporate contracts may coincide with upward momentum.

Like, Market corrections: A broader decline in the tech market could provide discounted access to high-potential stocks like D-Wave.

Like, By timing your investments carefully, you can improve the balance between risk , risk and reward.

8. Keep an Eye on Future Industry Trends dwave share price

The quantum computing market is evolving and its important to stay ahead of the trends:

Accelerating commercial applications: As more industries integrate quantum solutions, D-Wave’s market potential will , will grow.

do you know Technology Milestones: Qubit’s stability, scalability, and software efficiency are critical factors , factors influencing long-term commitment performance.

And oh yeah, do you know Global investment in quantum technology: Government and private sector funding in quantum computing could expand the industry, benefiting D-Wave.

And yes, by being proactive rather than reactive, investors can strategically position themselves for upcoming developments.

Conclusion

Thanks to its innovative technologies and strategic partnerships, dwave share price has achieved a prominent position in the quantum computing industry. And oh yeah, Understanding the factors , factors affecting dwave share price is key for investors looking to profit from this emerging sector. Technological and market breakthroughs, market adoption, strategic collaborations, econom

ic conditions and the regulatory environment play an important role in shaping market sentiment. Recent trends indicate moderate growth, supported by quantitative solutions and positive media coverage. do you know However, potential investors should be aware of the risks, including market uncertainty, competition, technological limitations and regulatory challenges.

Also Read This: Best charfen.co.uk: The Ultimate Resource for UK Users