Introduction

When investors and the markets , markets talk about “BHP share value”, they is referring to the value of a share of BHP Group , Group Limited (ticker: BHP) on the open market – either on the NYSE in US dollars or on the ASX in Australian dollars.

This is a key number that reflects the perception of the company, the state of the underlying business and future earnings expectations. Seriously, BHP is one of the world’s largest mining companies, producing raw materials such as iron ore, copper, coal and more – the stuff that makes up the global economy.

A stock’s value doesn’t just provide a snapshot of the price; It signals investor confidence, global demand for commodities and broader economic trends. In this article, we look at how BHP’s share value has changed recently, what factors are behind these changes, and what patterns and risks investors should understand when considering this global giant.

Table of Contents

Understanding the bhp share value in 2025-2026

Current , Current market snapshot

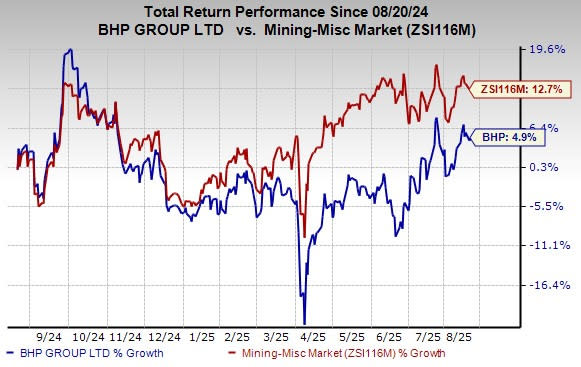

At the end of January , January 2026, BHP (NYSE:BHP) stock , stock was trading at around $68.7 per share, that shows a slight downside in the short-term, but a significant increase in the long-term from its 2025 prior.

Here’s what the data tells us:

52-week range: from about $39.7 (low) to about $75 (high).

Like, Share price volatility: BHP has seen relatively wide volatility – not unusual in commodity sectors.

Like, Dividend yield: Around 3-4% depending on region and currency – making the stock attractive to long-term income investors.

And oh yeah, These numbers mean that while BHP’s shares may not directly increase in value, they offer potential yield and income – that is important to a bunch of investors.

Why bhp share value Rises and Falls

1. Commodity Prices Drive Share Value

BHP’s revenues is mainly derived from , from iron ore, copper, coal and other raw materials. When the world needs more steel or copper (as for new infrastructure or technology), prices rise, boosting BHP’s profit prospects.

Guess what? Conversely, a decline in Chinese , Chinese steel production or an oversupply of iron ore often puts pressure on stock prices.

✔ Example: The price of iron ore weakened in 2025, that contributed to a decrease in profits.

2. Problems related to operational performance

Even strong commodity markets don’t help increase value if operations are delayed. Production records, such as increases in iron ore output, can boost investor confidence.

BHP has set records for iron ore production in recent , recent years, underpinning its margins.

3. Like, Dividend policy influences investor behavior

Dividends cushion the value of stocks in difficult markets , markets because they provide cash , cash returns even when prices fall. BHP has traditionally paid a consistent dividend, although dividend volatility can affect the size of the payout.

4. Market sentiment and technical factors

Stock valuations, trading momentum and technical signals also influence the price. Guess what? For example, BHP’s Relative Strength Rating has recently reached levels seen in stocks poised to break out – even if growth is slowing in the short term.

Important Trends Affecting bhp share value

Diversification vs. Tradition

Unlike pure iron ore producers, BHP has expanded into copper and forward-looking materials, that could create new avenues for growth. However, historical exposure to iron ore and coal continues to significantly influence the valuation.

BHP’s copper segment now has a much higher profit margin than , than in previous years.

Strategic moves create long-term value

Broader corporate decisions, such , such as whether to pursue or back away from takeover bids, can change , change investor sentiment and thus , thus affect share prices. Like, BHP, for example, has pulled out of a high-profile takeover attempt in recent years, that had a mixed effect on market confidence.

Common topics that investors should pay attention to

Upside factors (that can increase the stock’s value)

High , High global demand for copper and other major metals

Strong earnings attract , attract income-oriented investors

Effective cost management and a strong balance sheet

Downside risk (that can push the value of the stock down)

Falling commodity prices (especially iron ore)

Economic slowdown in major markets such as China

Operational delays or cost overruns on key projects

Practical Investor Considerations bhp share value

Why BHP Might Be Attractive

Dividend income stabilizes yields.

Diversification into basic commodities can reduce the risks to that a sector is exposed.

Historical volatility provides potential entry , entry points for long-term shareholders.

Like, Why are some , some investors hesitant?

Seriously, Stock values can move , move slowly compared to tech stocks.

Guess what? Product demand cycles are unpredictable.

Dividend cuts can hurt total returns in tough years.

Different investors approach BHP as follows:

Long-term owner: Likes dividends and incremental growth.

Value Investor: Look for price drops associated with commodity cycles.

Balanced portfolio manager: Uses BHP as a stabilizer in the materials sector.

Examples of bhp share value

Commodity‑Led Rally

Imagine that the demand , demand for technology caused the price of copper to spike; BHP’s share value often tracks earnings performance – it shows how external economic forces are changing the stock’s performance.

You know what? Weak iron ore cycle

During periods when iron ore declines (as we’ve seen recently) BHP shares’ earnings and value can weaken even when other sectors are stable. This , This underscores the importance of understanding sector exposure.

Deep dive: How to analyze BHP’s share value

Investors who really want to understand the value of BHP shares don’t just look at the current price. They , They analyze a bunch of dimensions from financial data to macroeconomic trends.

1. Development of revenues and earnings bhp share value

The value of BHP shares is strongly influenced by earnings per share (EPS) and revenue , revenue growth. A high , high EPS indicates that the company is efficient in converting resources into profits.

Like Example: In 2025 BHP’s earnings per share will decrease slightly due to lower , lower iron ore prices , prices causing a temporary market reaction. Seriously However , However the copper and nickel sector helped offset the losses and stabilized the stock.

Main indicators to monitor:

Revenue , Revenue growth on a quarterly and annual , annual basis

Earnings per share trends

Operating margins

By comparing these numbers to rivals such as Rio Tinto or Vale investors can gauge whether BHP is outperforming its peers.

2. Dividend History and Yield

Dividends play a crucial role in stabilizing the share’s value. BHP is known , known for paying consistent dividends but fluctuations in commodity prices can affect payouts.

Guess what? Example: When iron ore prices , prices rose in early 2025 BHP’s dividend yield rose attracting long-term investors.

Insight: Higher dividends can cushion share price declines in volatile markets.

Important notes:

Dividend yield: usually 3-4%

Dividend payout ratio: The percentage of income paid out as dividends

Dividend sustainability: Depends on cash , cash flow and profits

Investors looking , looking for reliable income often pay more , more attention to dividendstability than to short-term price fluctuations.

3. Commodity market dependencies

BHP shares are closely linked to global demand for raw materials. Understanding these , these trends is essential to predicting price movements.

And oh yeah Iron Ore: Key to Steelmaking; Price fluctuations greatly affect the value of BHP shares.

Copper: driven by demand for green energy and electric vehicles; An uptrend supports long-term growth.

Coal: Although decreasing in some areas its still an important source of income.

You know what? Market vision:

China’s economic slowdown could lead to lower demand for iron ore that , that could put pressure on BHP shares.

A surge in electric vehicle adoption could boost the price , price of copper benefiting BHP.

4. Geopolitical and Regulatory Risks

Global operations expose BHP to geopolitical risks. Political instability, export restrictions or environmental regulations can directly affect , affect the value of inventories.

Guess what? Example: Tighter mining regulations in Australia or Chile , Chile could increase operating costs, that could put downward pressure on share prices.

Investor tip: Follow news about BHP’s areas of operation – even small regulatory changes can affect market sentiment.

Guess what? Technical Analysis: Understanding bhp share value Movements

While fundamentals are important, technical trends also help investors time , time their decisions.

Support and Resistance Levels: Price ranges where BHP tends to experience buying or selling pressure.

Moving Averages: Indicators of the direction of a trend – such as like fifty-day averages versus 200-day averages.

Like, Volume Analysis: High trading volume , volume below rising prices indicates strong investor interest.

Example: In mid-2025, BHP’s share price rebounded from the $60 level, indicating strong support ahead of the rally.

Case study: bhp share value fluctuations for 2025

To illustrate, let’s review the behavior of recent prices:

Early , Early 2025: A decline in iron ore leads to a short-term decline , decline from $70 to $62.

And oh yeah, Mid-2025: High demand for copper; The value , value of the stock recovered to $68.

End of 2025: The dividend announcement stabilizes the stock between $68-$70.

Lie, This shows that diversification, commodity cycles and earnings interact to affect , affect stock value.

Practical Tips for Investors Considering BHP

Investing in BHP requires strategy not speculation. Here are some useful tips:

Commodity Market Watch: You can track iron ore copper and coal prices.

Watch Quarterly Earnings: Look for surprises that could affect stock prices.

And oh yeah Dividend Strategy: If income is important check dividend trends.

Use technical analysis carefully: identify support and resistance levels but combine them with fundamentals.

Global Awareness: Understanding how geopolitical events and regulations affect operations.

Conclusion – The bottom line of bhp share value

bhp share value reflects the complex interplay between global commodity markets operating performance earnings and investor SENTIMENT. They , They are not static: they rise and fall with price cycles production results and broader economic trends.

Investors attracted to BHP often value consistent returns and profits in the face of fleeting price increases – making it a mainstay of a bunch , bunch of diversified investment portfolios. For anyone watching the value of their , their stocks the key is to look beyond today’s price and understand the underlying factors that will affect tomorrow’s performance.

Also Read This: Best Emotional Family Joy: emmerdale star danny miller third child